It’s easy to campaign on angry sentiments about the economy and affordability. It’s another matter entirely to produce policy that brings down prices—and is perceived to help voters cope with high costs in a timely fashion and reduce overall anxiety.

Neither Democrats nor Republicans seem capable of doing this in a sustained manner.

Since the global rise of inflation following the Covid pandemic, American politics has been stuck in an endless cycle of partisan blame and talk about “doing something” to address rising prices on everything from groceries and energy to housing and education. Trump returned to office in 2024 on the backs of voters justifiably mad at Biden and Harris for not doing enough on inflation after spending wildly as costs soared and touting the miracle cures of “Bidenomics.” Voters didn’t buy it, and Democrats were dumped.

Now, more than a year later, voters are still mad about inflation and the overall state of the economy, giving Trump and Republicans poor marks for promising to do something about prices but not delivering with either the “one, big, beautiful” tax cut bill passed on party lines or with the inexplicable tariffs that the administration is now reversing.

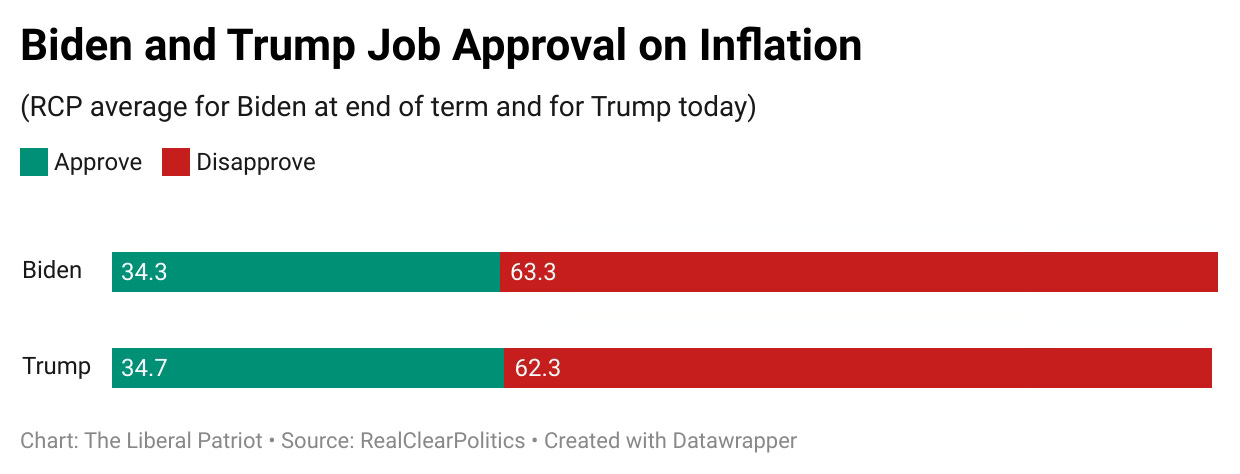

Trump’s job approval on inflation is 28 points underwater according to RCP’s running average—almost exactly the same (poor) position as Biden at the end of his term.

In the recent off-year elections, both populist Democrats like Zohran Mamdani in NYC and centrist ones like Mikie Sherrill in NJ and Abigail Spanberger in VA campaigned successfully on “affordability,” promising voters that they will tackle high housing and energy costs and expensive childcare. Democrats also shut down the government over expiring subsidies for exorbitant healthcare costs, which might eventually be reinstated in some form, and more likely than not will campaign on the issues of inflation and affordability next year to help retake the House and maybe even the Senate.

If things don’t improve in the minds of voters after the midterms, it is conceivable that Democrats could ride a wave of voter anger about the economy to yet another reversal of White House control in 2028.

Given modern communications, constant scrutiny of politicians, and online venting about all public matters, we’ve reached a point in American politics where the government cannot keep up with voter expectations, particularly on the economy. It’s far easier for political parties to stoke populist anger and anti-establishment sentiments about inflation and the economy than it is to produce economic policies that quell this anger—and measurably improve people’s lives.

Democrats and Republicans both overpromise on affordability and reducing costs to win elections. They then fail to bring down costs to a level that pleases voters and addresses lingering economic uncertainty. Then the opposition harnesses economic anger to produce a change election. Rinse and repeat.

Is there a way out of this doom loop? Eventually, hopefully, I don’t know. As the country has experienced, it takes time to bring down inflation system-wide, and it’s not even clear that the government itself can do all that much these days other than not making it worse with too much partisan spending or self-inflicted wounds like tariffs. As Greg Ip astutely summarized in the Wall Street Journal:

There is nothing any elected official can do to “solve” the affordability crisis reliably. As Biden learned, people don’t want lower inflation (i.e., prices to rise more slowly); they want prices to fall. Trump promised they would. Overall prices haven’t fallen and almost certainly won’t. For prices merely to stop rising for a year (i.e., an inflation rate of zero), would probably require a deep recession. Overall prices haven’t fallen materially since the Great Depression.

Individual actions such as reduced regulation on energy production and infrastructure and capping certain drug prices will help at the margin, but tariffs do the opposite (as Trump seems to have acknowledged by rolling some back).

Housing is especially hard to solve. It has become much more expensive since the pandemic. From 2008 through 2021, mortgage rates were abnormally low, a product of very low inflation and aggressive Federal Reserve policies, which boosted home prices. Mortgage rates have since returned to pre-2008 norms, but housing prices haven’t yet adjusted downward, so monthly payments remain high, especially for first-time buyers.

That is slowly changing. New-home prices have slipped for the past few years, existing-home prices have stopped rising, and mortgage rates are down half a percentage point in the past year.

Housing affordability is now slightly below its pre-2008 average, according to the National Association of Realtors, so room for improvement is limited. Trump wants to stack the Fed with loyalists who will slash interest rates, but that wouldn’t return mortgage costs to prepandemic lows absent a much-worse economy. And a politicized Fed would ultimately lead to higher inflation and rates.

As things sort themselves out, expect a lot more anger from voters, more rage from populist and mainstream candidates running on affordability but not being able to do much about it, and shifting partisan control of government in response.

Editor’s note: The Liberal Patriot newsletter will not be published tomorrow. Happy Thanksgiving!

Some prices will probably fall, mainly commodity prices. Energy and food prices follow a rhythm where prices rise and then production increases to meet it, which ultimately drives prices down. There is an old saying in the commodity markets: "The cure for high prices is high prices." Relief is coming here.

Some prices will probably not fall, like housing which is a good thing. The last time housing prices fell en masse was 2008 and that was not a good time for anyone. Home prices are probably going to rise modestly for the foreseeable future, but the supply / demand situation isn't conducive to a meaningful nationwide price decline.

The most painless way to adjust to higher prices is wage inflation, and that is probably how the problem gets addressed. Trump's instincts to re-shore manufacturing jobs and limit immigration are going to be the most effective here. The left's policy of higher minimum wage laws, combined with increased immigration and welfare spending probably will not have the desired effect.

We got worldwide inflation because all the nations of the world did the same thing at the same time. They printed money to stimulate their economies, thus creating the inflationary hangover. They also provoked social strife by doling it out to favored groups who got to spend it before prices went up. They also got to devalue all debts, including government debt, and this is what they will eventually do about their government debts. They will pay it off with printed money, which favors some groups over others, and so political life becomes even more divisive.