On July 4, as Americans were gathering with family and friends to honor the nation’s 249th birthday, something else happened in Washington, DC: President Trump signed into law his first major legislative accomplishment, the One Big Beautiful Bill (OBBB) Act. Amidst a busy six months for Trump’s administration, the new law hasn’t received as much attention as many of his executive and foreign policy actions, but it is likely to be a defining part of his second term.

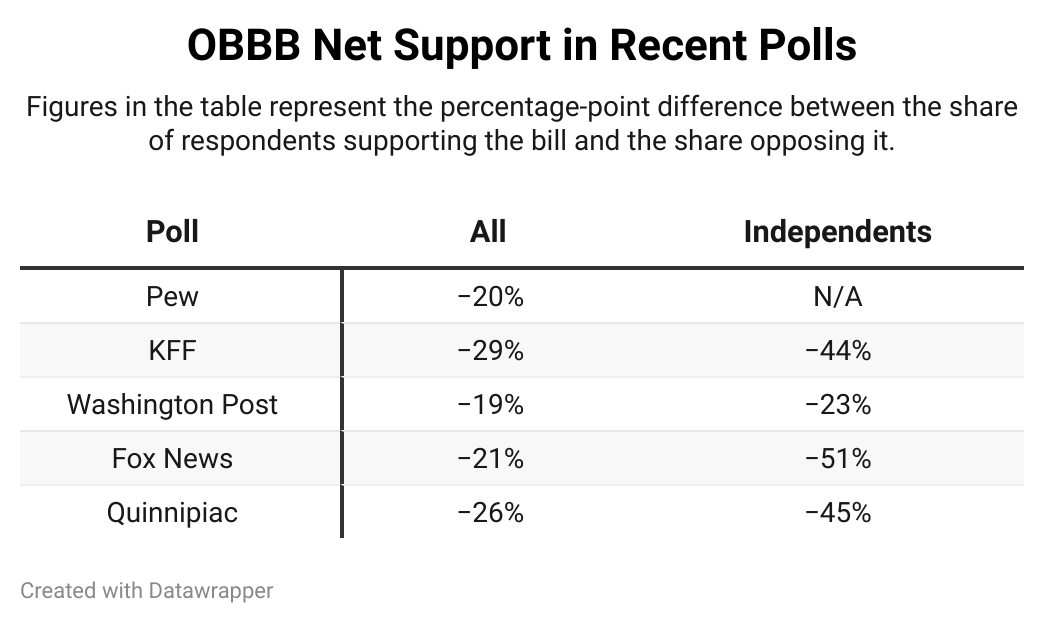

Trump has described the law, which includes a host of provisions related to tax policy, Medicaid, immigration, and more, as “very popular.” Early signals, however, indicate that the president has a long way to go in persuading Americans that the law is good for the country overall—and for them, specifically. In the month leading up to the bill’s final passage, five major polls gauged the public’s attitude about it, which were decisively negative.

Worse still: the share of the public opposing the bill grew as discussion about it ramped up in Congress and it came closer to passing, and polls that restricted their samples to only registered voters showed stronger opposition than those that did not. Below is a look at what we learned from these five polls.

Pew Research

In the Pew Research survey, conducted in early June, 49 percent of respondents opposed the bill. By comparison, 29 percent supported it and 21 percent had no opinion. But more interesting was that the momentum was with the bill’s opponents. Among the 80 percent of Democrats who opposed it, fully 67 percent were “strongly opposed.” Meanwhile, only a slight majority of Republicans (56 percent) supported the bill, and just 25 percent said they “strongly support” it—not especially encouraging numbers for the OBBB’s supporters.

Moreover, the public largely agreed that the group that stood to benefit most from the bill was high-income earners. Fifty-five percent of respondents said the bill would help them versus just 11 percent who thought it would hurt them. By contrast, majorities believed it would hurt middle-income people (51 percent), lower-income people (59 percent), and “people like you” (51 percent). A small majority (51 percent) also feared that the law will have a negative impact on the federal deficit, including even one-third of Republicans.

Pew also gauged the public’s attitudes on five individual measures, and the results here were slightly more mixed. Three of the five received plurality support, including extending Trump’s 2017 tax cuts that were set to expire at the end of the year (42 percent), increasing SALT deductions (39 percent), and increasing taxes on colleges and universities with large endowments (43 percent). On the other two matters, though, Americans were less sympathetic—pluralities opposed measures to end federal tax credits for electric vehicle purchases (42 percent) and for companies producing wind, solar, or nuclear energy (50 percent).

Kaiser Family Foundation (KFF)

The early-June Kaiser Family Foundation survey showed the greatest amount of opposition to the bill of the five polls: 64 percent viewed it unfavorably against 35 percent who viewed it favorably (though notably, it appears the survey question may not have given respondents the option to express no opinion).

The KFF poll was among the more detailed, asking questions about the bill’s myriad components related to healthcare. Among all respondents, 60 percent said they believed cuts to Medicaid are primarily about “taking health care away from people who need it,” including 89 percent of Democrats, 63 percent of independents, and even one-third of Republicans. By contrast, 39 percent believed the cuts will come from “reducing fraud and waste,” including 68 percent of Republicans, 36 percent of independents, and just 11 percent of Democrats.

Medicaid work requirements were popular overall, with 68 percent supporting—including 66 percent of independents and even a small plurality (51 percent) of Democrats—against 32 percent opposing. KFF also tested messaging both for and against these requirements and found:

Support increased to 79 percent if people believed savings would help fund Medicaid for vulnerable groups like the elderly and indigent children;

Support decreased to just 40 percent if they believed the change would have little or no impact on the share of Medicaid enrollees who were working but would increase state administrative costs to oversee program eligibility;

Support decreased to an even lower 35 percent if they believed that most people on Medicaid were either already working or “unable to work because they are either disabled or caring for a family member” and that “such a requirement would put many of them at risk of losing coverage due to the difficulty proving eligibility through required paperwork.”

The Washington Post

The Washington Post’s poll, also conducted toward the beginning of June, showed the least amount of opposition to the bill (42 percent), though it had the largest share of respondents with “no opinion” (34 percent, including a plurality—42 percent—of independents). Of note, only a plurality of Republicans (49 percent) supported the bill at that time as well.

Of the five polls, the Post’s was the only one to break down support and opposition to several of the bill’s individual components (15, to be exact). The results were mixed: five of the policies had majority support, two had plurality support, one saw an even split, one had plurality opposition, and six had majority opposition.

The two most popular provisions (polling at over 70 percent support) related to increasing child tax credits and extending tax cuts for individuals making under $100,000 annually. These were also the two policies with by far the most support among Democrats and the top two among independents as well.

Eliminating taxes on tips was also highly popular, with 65 percent support and substantial net support among Democrats (+27) and independents (+40).

The remaining two policies with majority support were both just over 50 percent: extending tax breaks for those earning between $100,000 and $200,000 (53 percent) and adopting Medicaid work requirements (52 percent).

Of the two measures with plurality support, the top one was extending Trump’s 2017 tax cuts for everyone (including high-income earners), which received 49 percent support, though a quarter of respondents had no opinion on the matter. The other—ending EV tax credits—only had slight net-positive support: 42 percent against 37 percent opposing it, with independents only marginally likelier (+8) to support the change.

Respondents were evenly split on repealing some student loan forgiveness programs. There were wide partisan differences (+40 among Republicans against -43 against Democrats), but even independents were relatively divided, supporting the move by an extremely slim margin (+2).

The remaining measures all had plurality or majority opposition, including among independents. These included boosting military spending (-5), adding $50 million for building more of the southern border wall (-16), extending corporate tax breaks (-19), and ending tax breaks for solar, wind, and geothermal energy (-20). The remaining three provisions were extremely unpopular, with less than 20 percent support and net support of less than 10 points among even Republicans: extending tax breaks for those making more than $400,000 (-22), spending $45 billion to build and maintain new migrant detention centers (-37), and cutting federal funding for food assistance (-43), the last of which was had net-negative support among Republicans.

Fox News

The Fox News poll only asked three questions about the bill, but they surveyed registered voters (the previous three sampled all adults) and gauged attitudes across a host of additional demographic groups. The poll’s headline is that a large majority (59 percent) opposed the OBBB, and this finding was consistent across virtually every category of voters. Notable groups with majority opposition include:

Hispanics (58 percent)

Voters earning less than $50,000 a year (60 percent)

Non-college voters (59 percent)

Suburban voters (62 percent)

Rural voters (55 percent)

Independents (73 percent)

In fact, the bill found favor among just five demographic categories: Republicans, conservatives, “very conservative” voters, 2024 Trump voters, and white evangelicals—all groups that overwhelmingly approve of the president in virtually every respect.

The other key takeaway is that nearly half (49 percent) of respondents said they believe the law will hurt their family, while less than one-quarter (23 percent) said they thought it would help.

Quinnipiac

The Quinnipiac poll, the last one conducted before the bill’s passage, similarly asked only three relevant questions: the extent to which respondents had heard about it, whether they supported it on the whole, and whether they supported one specific provision. They, too, limited their sample to registered voters.

Overall, about 70 percent of voters had heard or read at least “some” about the bill. Interestingly, the group that had paid the most attention was Democrats (42 percent had heard “a lot”), and they had overwhelmingly negative views about it: a mere one percent supported its passage compared to 87 percent who opposed it. For their part, fewer Republicans (31 percent) had heard a lot about the bill, and though a large majority supported it (67 percent), sizable shares either opposed it (17 percent) or had no opinion (16 percent). But the group driving the bill’s negatives was independents. Fully two-thirds (65 percent) opposed it while just 20 percent supported it.

The poll also gauged voters’ attitudes on the Medicaid work requirements. The public was evenly split, with 47 percent supporting against 46 percent opposing. However, the split was not neatly along partisan lines. Twelve percent of Republicans opposed this change while 17 percent of Democrats supported it. Among independents, the provision was underwater by 10 points, 43 to 53.

These five polls paint a pretty clear picture: though Americans are open to some of OBBB’s individual components, they oppose many of them and fear that overall it won’t help people like them. There’s no doubt that Democrats, especially those running in competitive races, will seek to capitalize on these early dour sentiments toward the new law heading into next year’s midterms. Whether Trump and his Republican allies can convince the American people otherwise remains to be seen.

I suspect the opposition on the right is that it didn't cut spending enough.

So these voters may not be fans of the bill, but that doesn't mean they will vote for the left.

Perhaps if The Liberal Patriot's Trump Derangement Syndrome contintingent spent less time responding to the winds of opinion polls and more unearthing facts and tactics it could build upon rather than sacrifice its credibility.

There's a reason and a place for alternative publications like The Liberal Patriot, and as a retired career journalist I strongly recommend subscribing to a diversity of viewpoints. But I am not going to join so many others who have abandoned the so-called "Legacy media" as biased dinosaurs when there is much to be learned still from many of them.

A case in point:

https://www.wsj.com/opinion/no-one-is-gutting-the-safety-net-e3029eb4?st=voJir9